First Year

Summer - Foundation Program begins

This course presents economic principles that explain the operation of markets and firms and shows how economic reasoning can provide useful insights for practicing managers, particularly with regard to strategies for dealing with the firm’s business environment. Theories of consumer demand, the economic nature and function of business firms, optimal business decision rules, game theory, and economics of strategy, are presented. Efficiency criteria pertaining to the operation of firms and markets, the role of property rights, the scope for public policy, are also examined.

The economy has a massive influence on business. Managers must anticipate the behaviour of households, other enterprises, and foreigners as well as the actions of governments and the central bank. This course is designed to help you understand the forces that drive the economy and to develop effective business strategies in this context.

We are currently living in unprecedented times, with the impact of Covid-19 still playing out on all aspects of our lives, including our working and professional livelihood. Relating to business and economics, there is no shortage of topics to analyze as this health crisis has affected every single sector of every economy worldwide. Fiscal stimulus for COVID relief has also impacted the economy, including producing high rates of inflation with Central Bank policies to reduce inflation through higher interest rates. And the conflict in Ukraine has had impact on economic trade and capital flows and has influenced economic alliances between countries. Our economic models will assist in understanding the implications of these events, including the impact on the business environment.

The course is designed to provide a foundation in financial accounting. The course assumes no prior knowledge in accounting. With this in mind the first 2 lectures will address fundamentals that will lead to the more detailed topics to follow.

Specific objectives include:

- Understanding the framework of financial reporting, including the key elements of Generally Accepted Accounting Principles (GAAP).

- Introducing the CPA Canada Handbook as a reference source.

- Understanding the objectives of financial reporting.

- Basic interpretation of financial accounting information.

- Accounting for transactions.

- Understanding key elements in the selection of accounting policies or choices in the determination of accounting estimates.

- Understanding the workings of a financial reporting system and the interrelationships between the various financial statements.

- Introduction to professional judgement, in practice and on professional examinations.

- Financial statements are a form of communication and ASPE and IFRS are the language.

- Detailed review of International Financial Reporting Standards (IFRS) and Accounting Standards for Private Enterprises (ASPE) in Canada for the topics in the course.

- To introduce the use of Excel as a tool in problem solving and presentation.

- To prepare you for later courses in the program such as Intermediate Accounting, Auditing and Decision-making courses.

By the end of the course, students should be prepared to design and implement basic accounting systems, record transactions, prepare a set of financial statements and identify and resolve key accounting issues in a case setting using the knowledge gained in this course combined with professional judgment.

In addition, the course will help develop the student’s linguistic intelligence – specifically their ability to utilize and apply accounting terminology as well as the student’s logical-mathematical intelligence (e.g., the capacity to analyze problems logically, carry out mathematical operations, and investigate issues). As well, several of the pervasive qualities referred to in the CPA Canada Competency Map will be developed, including various professional skills (e.g., communications and problem solving)

Management accounting involves facilitating decisions that are faced by management by providing inputs and decision techniques for those decisions.

For example, where a decision is based on costs, those costs have to be derived accurately and used properly in a decision for that decision to be useful. The costs required may have to be produced by an accounting system or computation that is kept accurate by adherence to a company policy. All of these aspects will be studied during this management accounting course and those that follow.

A management accountant must be able to identify the correct costs, and the best approach to solve the problem at hand. This will require the ability: to understand cost information, to develop costing systems; to identify and isolate relevant costs, to prepare capital budgeting analysis and other forms of analysis; and to develop appropriate policies and organizational structures with appropriate degrees of reporting.

The objective of this course is to develop an understanding of management issues and the tools used to identify and solve such issues. We will demonstrate that management accounting is most effective when it is developed in the context of the organization's strategy, rather than as an end in itself.

In addition, this course will offer an opportunity for students to examine the role, professional attitudes, and ethical expectations of the management accounting professional, and identify frameworks for ethical analysis and decision-making

This course is intended to introduce you to the essential principles of marketing: how firms and consumers behave and what strategies and methods marketers may use to successfully operate in today’s dynamic environment. Specifically, the course goals are:

- To introduce you to marketing strategy and to the elements of marketing analysis: customer analysis, company analysis, and competitor analysis.

- To comprehend the concept of brand positioning and its crucial value in achieving the strategic goal and in effectively designing the tactical tools used to achieve that goal.

- To familiarize you with different marketing tactics, namely the elements of the marketing mix (product, pricing, promotion, and distribution strategies) to enhance your problem-solving and decision-making abilities.

- To advance your appreciation of the marketing process as a general framework for thinking about problems and looking at the world in general.

In this course, we will be taking a strategic approach to marketing. Strategic marketing involves determining which customers your organization should serve, which products and services it should offer them, and how. This course is intended to develop an analytical framework for these decisions. Emphasis will be placed on developing a position in the marketplace that provides value to customers that is not readily duplicated by competitors. In other words, we will focus on ideas that help the firm differentiate itself from its competitors to offer unique value to its customers. As a result, the first half of the course will develop models for understanding customers, competitors, and the organization itself. The second half of the course will examine the tools available to marketers to execute strategic decisions, with an emphasis on coordination among tactics and consistency with strategy.

The object of this course is to give you an understanding of how Statistics operates in Business and Commerce. It will become clear how pervasive Statistics has become and how essential the basic concepts are to modern business practice. You will learn thoroughly the basics of data analysis and the fundamental notion of statistical inference. The statistics learned in this course will provide the knowledge necessary for you to apply the basic techniques in a wide variety of circumstances and, perhaps more importantly, will enable you to assess the legitimacy and significance of the many and varied reports that you will come across during your career.

Fall - 2 Year MMPA program begins

MMPA Communications teaches communication theory and practice that will prepare students for careers as accountants. The course emphasizes Plain Language practices, narrative theory, and person-centered communications. This is an experiential learning course—we will learn by doing.

The coursework will:

- Identify principles that govern communications;

- Define and discuss what constitutes “good” and “bad,” and ethical and unethical communications;

- Uncover practices in writing and public speaking that prepare a person for professional settings;

- Detail editorial practices, including strategies for giving feedback to peers in a professional setting.

The integration of subject matter taught in separate function-oriented, management and accounting courses is essential to its effective application in real-world, complex business and professional decisions. The course is designed to introduce students to the frameworks and challenges of integrating function-oriented learning by bringing together existing MMPA Frameworks (Leadership Development; Howard Gardner’s Multiple Intelligences Theory; Developing a Global Mindset) and Integrative Competitions (Financial Reporting, Finance, Communication & Team Building Case Competition; Audit File Contest; CPA Hackathon) and creating new, leveraged opportunities for integration and analysis.

The course will examine data sources used as inputs to decision-making (structured, unstructured, data sets, data feeds and big data). It will also give students an introduction to coding and data analytics in Python through hand-on sessions.

There are two Integrative Competitions in the Fall term. Students will be placed in teams in order to complete these Integrative Competitions (same team for both Integrative Competitions). Additional reflection papers relating to the Integrative Competitions will be submitted by students as noted in this course outline.

MGT 1181 will help develop linguistic and logical intelligences through use of professional accounting standards including the CPA Handbooks and through case analysis. It will also help with inter- and intrapersonal intelligence through the Integrative Competitions. The course will use as a reference point, the CPA Competency Map which maps out the competencies expected of professional accountants needed by outstanding professional accountants. The competencies found in the CPA Competency Map covered in this course include those noted in the MGT 2250, MGT 1330 and MGT 1323 course outlines. In addition, the course will touch on Section 7-7 of the CPA Competency Map Knowledge List, which covers data analytics and information systems.

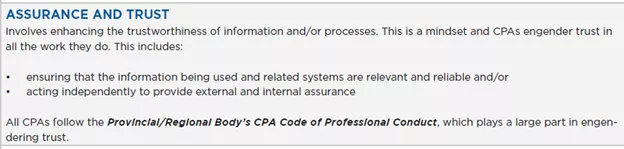

Ethics & Governance (MGT1202H) provides an understanding of the individual and organizational behaviour expected according to business and professional ethics, and governance requirements. Trust is fundamental to the profession of accounting, of assurance providers, and of businesses that expect to build a positive reputation. Ethics are fundamental to developing and maintaining that trust, and ethics and governance are vital to the development and understanding of the role and accountability of corporations, and of the accounting professional in today’s changing times and future challenges. Ethics are therefore critical to professional accountants and to corporations in the future, and good governance practices need to guide employees and agents to appropriate behaviour. Specifically, this course covers:

- The emerging ethics environment for business and the accounting profession.

- Ethics tragedies and trends, and the resulting new expectations for governance and ethical behaviour of directors, managers, and professionals.

- Frameworks for defensible ethical analysis and decision making.

- The functions of the corporate governance system and challenges it must deal with.

- Some of the major ethics pitfalls to be faced by professional accountants, and how to deal with them, and

- How to develop a governance system to:

- Develop a corporate culture to guide and manage employee behaviour,

- Provide ethical assurance for officers, directors and other stakeholders, and

- Consider the important aspects of workplace ethics, international operations, social accountability, and audit, as well as crisis management and ethics risk management?

This course introduces competing expectations about the purpose of corporations and hence raises questions concerning the appropriate responsibility of their directors and managers to various stakeholders. It develops the position that the responsibility of managers for effective action extends not only to the familiar economic and market milieu, but to the wider social/public arena as well. Students will learn to analyze, question critically, challenge and change ethical and moral standards, priorities, points of trade-off and compromise to be applied to business and professional behaviour.

Course & Learning Objectives:

By the completion of this course, students will be able to:

- Identify, understand, analyse, and respond effectively to ethical and professional dilemmas.

- Anticipate ethical risks and dilemmas, and mitigate or avoid them, or take advantage of any opportunities presented.

- Appreciate the relationship between business and professional ethics and good governance, and in turn with personal and organizational success.

- Create effective governance systems to guide personal and organizational behaviour.

- Understand and deal effectively with important aspects of workplace ethics, risk and crisis management, and modern organizational accountability for stakeholder accountability on sustainability, ESG, and CSR matters.

In this course, the primary intent is to provide you with the basic background and tools that will allow you to facilitate and/or assess contemporary management information systems. This requires a solid understanding of (1) the process by which effective systems are designed and developed, (2) the key components of an effective entity wide internal control system, (3) the process by which efficient database design can be used to improve management information flow, (4) the contemporary issues involved in providing assurance services for management information systems and database reliability, and (5) emerging technologies creating market disruption.

At the end of the course, you should be able to:

- Appreciate the underlying technology supporting management information systems;

- Recognize emerging information technology trends;

- Understand the capabilities of enterprise resource planning (ERP) and accounting information systems.

- Design and develop a simple queries that would be used as a source for advanced data analytics;

- Document business processes and associated business risks;

- Understand a control framework for management information systems;

- Evaluate controls regarding completeness, accuracy, validity, security, effectiveness and efficiency;

- Understand business process life cycles, including: Order-to-Cash, Procure-to-Pay, Hire-to-Retire, Record-to-Report; and

- Converse intelligently on topics of evolving, disruptive and emerging technologies.

In addition to the academic objectives, students should improve their skills in the following areas:

- Critical Thinking: Students should improve their ability to analyze computer user situations through their analysis of the practical and real problems distributed in class. The class assignments and practical exercises provided during the class also have in-depth case analyses that encourage the students to think critically about real-world situations.

- Writing Skills: Students should improve their writing skills on the mid-term and final examinations.

- Computer Skills: Students are expected to improve their understanding of information technology, and to improve their computer skills by using MS Office software, particularly MS Access/Excel and the Power Query platform and exploring the internet for relevant and current information for the solution to problems presented during class discussions.

This course is designed to provide an understanding of the basics of audit theory/assurance concepts and practice. Evaluation of audit evidence to support a professional opinion on financial statements, generally accepted auditing standards, Canadian Auditing Standards (CAS), Other Canadian Standards (OCS) and other topics will be covered in order to develop this understanding. The CPA Canada Assurance Handbook will be used extensively as a primary technical source. Case simulations and textbook questions will be used to help integrate the theoretical and applied aspects of auditing. Since a significant focus of auditing is on financial statements, it is presumed that students will have a good understanding of the Canadian financial reporting framework, more specifically, ASPE and IFRS.

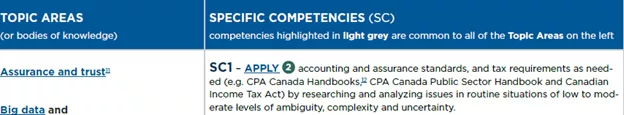

This course is strongly linked to the principles-based approach and the concepts and competencies found in the CPA Competency Map 2.0 covered in this course include:

Given that this course is based on both theoretical and applied aspects of auditing, multiple intelligences will be developed. The theoretical aspects of auditing will mainly develop logical-mathematical intelligence and the applied aspects of auditing will develop both linguistic and interpersonal intelligence. A professional accountant must be able to think logically, and reason deductively, but also must be able communicate his/her thinking and conclusions and work well with and understand others.

Objectives that are more specific include:

- Understanding and applying Canadian GAAS (CAS; OCS) and Canadian Standard on Review Engagements (CSRE).

- Review of the key aspects of the CPA Canada Assurance Handbook in order to set a strong foundation for the assurance component of professional examinations.

- Audit reports, special reports and other assurance engagements.

- Assurance planning and execution.

- Critical thinking, professional judgement and skepticism and improved business acumen.

- Development and expansion of enabling competencies.

- Case (Simulation) writing and integrative analysis with accounting

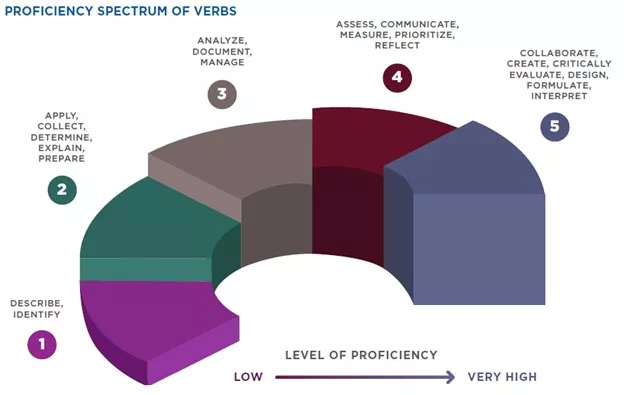

The course itself and the various course “take-ups” and deliverables (assignments, Audit File Contest etc.) have been carefully designed to assist your proficiency in audit and assurance as reflected as reflected in the following range of verbs:

The course introduces the basic ideas of Finance. The problems of Finance stem fundamentally from the existence of time and risk. Financial contracts, institutions and markets serve to overcome these problems for individual investors and companies.

Course & Learning Objectives:

MGT1330 analyzes the nature and role of financial markets and instruments, including stocks, bonds and options, decision making under risk and the pricing of risk, the informational efficiency of financial markets, the valuation of financial instruments, the optimal financing and dividend decisions of companies, and the economic role and the pricing of derivative instruments.

This is the first of three Canadian income tax courses in the MMPA program. This course focuses on the rules for computing inclusions and deductions for the purposes of computing net income for tax purposes from employment, business and property as well as the determination of net taxable capital gains and the recognition and taxation of other sources of income and deductions. The calculation of taxable income and taxes payables for individual taxpayers is the culmination of the course.

Course & Learning Objectives:

- By the end of this course students will be able to read, interpret and apply provisions of the Income Tax Act (Canada) to transactions and make recommendations supported by an analysis of the alternatives. Specifically, students will be able to deal with transactions that involve personal finances such as employment income and deductions, business income and expenses, investing transactions, related party transactions, family income-splitting transactions and tax-deferred savings plans such as RRSPs, RESPs, TFSAs and FHSAs.

This course focuses on decision making within the financial reporting environment in Canada and internationally. Emphasis is placed on identifying, interpreting, and analyzing appropriate Generally Accepted Accounting Principles (IFRS and ASPE) within a case environment to enhance problem-solving skills and the development of professional judgment.

Course & Learning Objectives:

In order to promote integration between accounting and other subject areas such as Auditing and Reporting (MGT 1323), Business Finance (MGT 1330),Communications (MGT 1160), Team Building and Integration and Professional Decision-making (MGT 1181), there will be two integrative initiatives involving these courses/subject areas.

MGT 2250 will contribute to an understanding of the values and beliefs, attitudes, skills, knowledge and experience that define an MMPA Leader.

MGT1090 is designed to help prepare you for success in your MMPA work terms and in your professional career goals, particularly in the attainment your Canadian CPA designation.

Winter - Co-op work term

MGT1090 is designed to help prepare you for success in your MMPA work terms and in your professional career goals, particularly in the attainment your Canadian CPA designation.

Second Year

Summer Session

The past decades have been a period of massive restructuring of the industrial sector with steadily intensifying global competition, rapid technological change, and increasingly demanding consumers along with an increased focus on service operations. Effective operations are critical to the success of any organization. Operations are highly integrated with other business functions such as marketing, finance and human resources. Operating decisions can provide organizations with a competitive advantage and help them achieve their strategic objectives.

This course will provide substantive tools for examining strategic operating decisions. Throughout the semester, we will see how various operating models provide intuition for design, capacity, location and production decisions, and the strategic implications of those decisions. Cases will be discussed to show how the principles learned play out in firms and to reinforce the learning process.

The course covers a broad range of topics including decision analysis, process analysis and design, forecasting, inventory, revenue and supply chain management, quality programs and initiatives, project management, capacity planning and management including scheduling and linear programming, and the strategic use of technologies.

This course is designed to advance the student’s understanding of strategic management. Strategic management studies the choices that top managers make and the consequences for the organization. A strategy is a sequence of contingent choices. Not all choices are the outcomes of decisions. Moreover, not all decisions are strategically motivated. Learning to distinguish between different types of choices and between strategic and non-strategic thinking is part of the goals of the course.

MGT 1301 builds on the knowledge gained in Microeconomic Theory (MGT 1210) and introduces concepts in competitive strategy. It provides a framework for understanding how economic reasoning can inform and develop useful insights for practicing managers, enabling the formulation of more powerful hypotheses and the development of richer strategies. Students will also utilize frameworks for industry and competitor analysis, examine how companies have established a sustainable competitive advantage, and consider the implications of discontinuous change on strategic decisions.

This course is an introduction to the concepts, theories and ideas guiding behaviour at work. This course will introduce you to a wide array of theories on topics relevant to understanding employee and managerial behaviour and provide insight and hands-on experience on how to use this knowledge to address problems that you will face in organizations. Some of the topics covered in this course include the study of personality, motivation, work attitudes and leadership. Some of the questions that we will address include: How do we effectively motivate employees? How does personality affect job performance? What leadership styles are effective with different employees? We will be applying theories at the organizational, group and individual levels of analysis and tying them in to examples of real-world applications. Students will also have the opportunity to work in small groups to complete group assignments.

It is important to understand that this course is not designed to help you pass your CFE exam. Rather, the content and focus of this course is to help you become a more effective organizational member and leader. What you learn in this course will help you succeed in your career. I use a variety of teaching methods to encourage both an intellectual understanding and a personal sense of the subject matter. Lecture sessions are coupled with experiential learning techniques (e.g., cases, exercises, and discussion) to facilitate an understanding of organizational behaviour concepts and demonstrate their application to management situations typically encountered in organizations.

Specifically, the objectives of this course are to:

- Introduce key theoretical concepts and research in the field of organizational behaviour (OB)

- Provide an understanding of the human and organizational setting in which you will be working

- Explore some of the skills that will help you to be successful in your career, especially in a leadership role

- Enhance your knowledge of human factors, such as personality and motivation, that impact behaviour at work

- Analyze the characteristic ways in which people respond to organizational dynamics such as decision-making and teamwork

- Examine the challenges today’s organizations face in attracting, motivating, rewarding and leading employees

- Apply the course materials to an organizational challenge and propose solutions to address it

The course is designed to provide students with a basic working understanding of various elements of Canadian "business law" of relevance to a practising professional accountant.

The course will commence with an overview of the structure of the Canadian legal system and then initially focus on the law of torts and the law of contract. The course will then shift in order to cover a series of other legal topics and issues that impact the business environment, including but not limited to, business entity law (e.g. partnership and corporate law), secured transactions, bankruptcy law and employment law. Other areas of law that may be of assistance to a professional accountant will also be canvassed, including an overview of intellectual property law and real property and mortgages.

The course learning objectives are:

- To obtain broad exposure to several legal areas including corporate and commercial law;

- To further develop basic legal research skills;

- To further develop writing skills;

- To further develop analytical skills;

- To accumulate a database of relevant and practical information.

The course will help students develop linguistic intelligence and logical intelligence since students will be working with statutes and case law and applying concepts learned to real life situations. Interpersonal and performance intelligence will also be emphasized through class discussions. We will continue to work on ethical decision making and applying strategic thinking within context.

This course continues where MGT 2250 left off, focusing on decision making within the financial reporting environment in Canada and internationally. We will continue to place emphasis on identifying, interpreting and analyzing appropriate generally accepted accounting principles within a case environment in order to enhance problem-solving skills and develop professional judgement. More complex issues such as employee future benefits, leases and taxes will be examined and therefore, there will be an increased emphasis on quantitative analysis.

In order to promote integration between core accounting courses such as MGT 2251 and Business Valuations (MGT 2281) and core MBA curriculum courses such as Fundamentals of Strategic Management (MGT 1301), there will be two integrative initiatives involving these courses.

The course will help students develop logical and mathematical intelligences since a portion of it is calculations oriented. Interpersonal and performance intelligence will also be emphasized through group work and case competitions. Refer to Gardner’s Multiple Intelligences model.

This interdisciplinary course combines concepts from financial and managerial accounting, corporate finance, and contract and insolvency law.

Traditional business courses often deal with financially healthy firms. However, failure is an inevitable reality for many businesses. The recent global economic crisis due to the effects of the Covid-19 pandemic illustrates this unfortunate reality. course aims to study the reasons why some firms find themselves in financial distress, alternative courses of action (including out-of-court and legal options) in response to financial distress, and the role of various stakeholders in the process.

The course intends to:

- Help students understand how to diagnose corporate financial distress and analyze internal and external warning signals. Students will be exposed to the use of distress prediction models.

- Help students understand the contractual tools used by creditors to monitor borrowers’ performance, accounting and reporting for problem loans, and likely actions upon violation of covenants.

- Help students understand the salient reporting issues that often precede an insolvency filing, such as impairments and going concern opinions.

- Help students understand the options available to companies in financial distress, including out-of-court restructuring.

- Familiarize students with the legal process for liquidations and reorganizations, and understand the accounting, governance, and financial decision-making issues that arise during and after emergence from bankruptcy.

- Expose students to the potentially lucrative area of investing in distressed assets.

The course covers the theory and application of models of business valuation and of mergers and acquisitions. It examines alternative approaches to valuation: Discounted Cash Flow, Relative Valuation, and Contingent Claim Valuation. Although the various approaches of valuation are not mutually exclusive, there can be significant differences in outcomes depending upon the model used. The course analyzes the reasons for such differences, and helps identify the correct model in specific real-world contexts. The course also applies the basic principles of valuation to mergers and acquisitions. It analyses the determinants of mergers and acquisitions, potential synergies from acquisitions and their valuation.

In this course we will focus on financial planning, with an emphasis on the interaction between the financial and strategic plans of the enterprise. Topics will include financial analysis and forecasting, as well as various aspects of working capital management. We will refresh on the underlying technical materials and then apply financial decision-making tools to a variety of practical business situations, using case analyses.

Fall Session

This is the second of three courses in Canadian federal income tax law for students enrolled in the MMPA Program. It is designed to give the student an understanding of more complex issues of Canadian income tax law and tax planning. This is achieved through a combination of lectures and the application of the law to practical problems and case settings. Topics include computation of corporate taxes, integration, corporate reorganizations, surplus distributions, partnerships and trusts.

Course & Learning Objectives:

Students are expected to demonstrate (by examination, assignment, and class participation) competence in the technical aspects of the tax law covered throughout the course.

It is not intended that students memorize specific tax provisions. All tax provisions are subject to change. Accordingly, the intent is that students develop an understanding of how the tax law works and the ability to apply the appropriate provisions of the Income Tax Act (Canada) in a given situation.

The broad objectives of this course are:

- To help you develop an understanding of the theory, concepts and practicalities of accounting for an investor’s interest in subsidiaries, associates and joint arrangements;

- To help you gain an understanding of the complexities in accounting for strategic investments, business combinations, and foreign currency translation with a focus on the needs of users of financial information;

- To help you understand the similarities and differences between International Financial Reporting Standards (IFRS) and Accounting Standards for Private Enterprises (ASPE) related to topics discussed in this course; and

- To help you develop judgment skills and to exercise professional judgment.

The course begins with an overview of the conceptual framework for financial reporting and an introduction to strategic investments. Accounting for business combinations and various types of strategic investments will be introduced and their application considered in depth. The latter part of the course will consider accounting for foreign currency transactions and foreign operations.

This course extends students’ knowledge in auditing and explores the importance and various aspects of auditing the computer and related information technology environments that host and process financial information. This course will focus on the understanding and management of the risks associated with computer-based information systems. It covers potential means to provide information technology controls and how to perform audits in these environments.

Course & Learning Objectives:

The main objective of this course is to provide a basic level of knowledge of auditing a computer and information technology (IT) based environment. In particular, the course will cover:

- a broad knowledge of the risks and exposures introduced by computer-based information systems;

- the types of controls that may be used to reduce such risks to an acceptable level;

- a framework for and case-based practice of controls evaluation in a computer-based information systems;

- the impact of computer controls on audit strategy; and

- the opportunities and risks associated with computer assisted audit tests throughout the audit.

The objectives of this course are as follows:

- To build your knowledge of the overall business environment and how it integrates into the audit process (i.e., risks, controls, control environment, data)

- To develop your technical understanding of the auditing process from an auditor’s perspective

- To help you understand the requirements of a firm providing assurance services and the standards they have to uphold to be compliant with CAS and the regulatory environment

- To integrate Audit Data Analytics into your thought process of assurance procedures

- To enrich your enabling competencies through a combination of individual and team-based work

- To develop the CPA mindset and learn about professional ethics, judgement, skepticism along with enhancing critical thinking and problem-solving abilities

This course is designed to introduce students to the CPA Competency Map 2.0. Purpose-driven enterprises that create value for all stakeholders must develop and implement a strategy to achieve their aspirations. A systems approach taking into consideration the complex interrelationships among various players and the dynamics of the external environment is necessary to achieve this goal. Management Control Systems are required to provide the information necessary for managing, measuring and monitoring decision making.

This course also prepares students to lead in analytics-driven organizations. Students will solve current business problems by evaluating alternatives and gaining insight from past performance. This course explores how information systems can be used to support decision-making, align incentives across an organization, and implement large-scale business strategies to maximize stakeholder value. The course uses data, methods, and fact-based management to support and improve decision making.

Course & Learning Objectives:

Management Control Systems are integral to effective strategy development and implementation which consequently create value for a corporations’ stakeholders. These systems provide the information necessary for measuring, managing, and monitoring decision making.

More specifically this course will enable students to:

- Understand the complex linkages between a company, its purpose, stakeholders, competitive strategy, capabilities, management processes, culture and its external environment. (Systems Thinking).

- Evaluate whether a company’s strategy and governance choices and consequently the organization’s capabilities and management control system for making choices and monitoring implementation are likely to deliver on the company’s purpose.

- Appraise the effect of stakeholder capitalism (vs. shareholder capitalism) on a company and assess the impact on strategy and decision making in a multi-stakeholder environment.

- Integrate management control systems with strategic choices, including corporate purpose, competitive and human strategy. Determine appropriate data collection, analysis, reporting and governance.

- Design management control systems to measure and monitor the effectiveness of strategy implementation and value creation from multiple stakeholder perspectives.

- Report to multi-stakeholders on value created for them, using financial and non-financial data provided by the company’s management systems. ESG and Sustainability Accounting Standards

The goal of financial accounting theory is to provide a set of principles and framework to explain existing accounting practices, and to predict behaviors of stakeholders who prepare, regulate, or use accounting information. This course focuses on the important accounting research and theory developments over the last four decades. We will illustrate the implications of the existing research for future accounting practices using real business examples and cases.

A mainstream of accounting research investigates the economic, social, and institutional forces that influence management's choice of accounting policies. Understanding how investors use and interpret accounting information is critical to guiding future financial reporting and accounting policies. The overarching objective of this course is to develop a good understanding of accounting research to enable a critical assessment of the problems facing the accounting profession now and in the future.

Finally, financial reporting and accounting practices continue to evolve in response to the emerging of new technologies and the advances in society, governance, and economies. We will explore how new technologies and other emerging economic and social issues may affect future accounting practices in the annual MMPA Conference.

The focus of this course is on Strategy and Governance (SG) and Management Accounting (MA). Any organization must have controls and activities in place to ensure that its strategic objectives and goals are met. Underlying these controls and activities are issues involving strategic decision-making, effective governance, risk management and performance evaluation. This course will integrate these issues and other important areas of SG and Management Accounting, such as business valuations, revenue and cost management and management systems and controls, with other topics covered in other courses using integrative case simulations.

MGT2090 is designed to help prepare you for success in your MMPA work terms and in your professional career goals, particularly in the attainment your Canadian CPA designation.

Winter - Co-op work term

MGT2090 is designed to help prepare you for success in your MMPA work terms and in your professional career goals, particularly in the attainment your Canadian CPA designation.

Third Summer

Summer Session

MGT2004 Advanced Concepts in Strategic Management builds upon the material covered in MGT1301 Introduction to Strategic Management and integrates topics students have studied in other MMPA Program courses as well. It introduces students to a number of advanced concepts in strategic management and also considers the implications current and emerging technologies may have for strategy. It fosters skills in strategic thinking, analysis, and decision making. The primary focus of this course is on multi-business organizations – that is, companies creating value across multiple production stages within an industry, multiple industries and / or multiple geographies. The decisions faced by these firms may include choices of diversification, the management of businesses in different geographies or at different stages of the value chain (e.g. the degree of vertical integration).

The course is designed to enable students to gain a better appreciation for the role of the Board and Senior Leadership in the formulation and execution of strategy, as well as related internal monitoring and control systems. Students will learn about new concepts, theories, tools, and technologies and hone their skills in analyzing complex strategic situations. Key issues will be examined from a theoretical and empirical perspective with the help of case studies, articles, textbook chapters, on-line research, a team project and active participation in in-class discussions. The course will enable students to further integrate the knowledge they have acquired in other functional areas of Management (e.g. finance, marketing, organizational behaviour, etc.).

More specifically this course will enable students to:

- Clarify the role of the Board and how it differs from the role of management.

- Better understand the importance of effective corporate governance in strategy formulation and execution, as well as in monitoring performance.

- Develop a deeper understanding of:

- Governance

- Sustainability

- Charting a Strategic Direction

- Competitive Strategy

- International Strategy

- Corporate Strategy

- The Role of Diversification in Strategy

- Strategic Execution

- Platform Strategy

- The Implications of Generative AI for Strategy

- Enhance the ability to articulate their thoughts in a balanced but persuasive manner through regular in-class verbal participation.

A very large proportion of economic and social activity is undertaken through government units and not-for-profit organizations both of which have accounting and control systems that differ from those of for-profit organizations. This course is intended to introduce the objectives, nature and challenges of these organizations, and the accounting, reporting, and control systems that are required by them.

The course will build on and augment the learning in other integrative and professional decision-making courses offered in the program (MGT 1181, 2282, 2283 and 2284).

This Master’s level course examines many of the tax issues, problems and planning opportunities professional accountants encounter in providing tax services to taxpayers. This is the third of a three-course sequence of taxation courses in the MMPA Program. It is, therefore, expected that participants have a good knowledge of the concepts of Canadian Taxation from successfully completing MGT 2206 and MGT 2207, Canadian Income Taxation I and II.

This course is designed to update, expand and integrate the knowledge and skills gained in the previous two courses. By the end of the three-course sequence, it is anticipated that students will be proficient at recognizing tax issues in business situations, developing and analyzing alternatives, locating the proper tax references to resolve issues and answer questions, and communicating their conclusion.

Specifically, this course will require students to be highly motivated and to dedicate adequate time to the readings and class preparation. Students are expected to conduct themselves with the utmost integrity and to maintain an optimal learning environment for themselves and others.

In this course students are given the opportunity to further develop their abilities to analyze problems logically, carry out mathematical operations, and investigate issues. This is referred to as the Logical-mathematical intelligence in Gardener’s Multiple Intelligences model.

The three-tax course sequence has been designed to provide participants with coverage of the competencies for taxation for the CFE.

Taxation has an important effect on business and investment decisions. This course is designed to integrate the taxation knowledge and skills gained in MGT 2206, MGT 2207 and MGT 2208 with the other technical competency areas of the CPA Competency Map through the use of integrative case simulations.

Some of the competencies found in the CPA Competency Map covered in this course include:

- 6.1 General Income Tax Concepts

- 6.2 Corporate Income Tax

- 6.3 Personal Income Tax

- 6.4 Income Tax Administration

- 6.5 Income Taxation of Non-Residents and Part-year Residents

- 6.6 Other Income Tax Matters

- 6.7 GST Matters

By the end of this course, students are expected to be proficient at preparing a solution to an integrated case while drawing heavily upon the enabling competencies of the CPA Competency Map:

- Professional and Ethical Behaviour

- Problem-Solving and Decision Making

- Communication

- Self-Management

- Teamwork and Leadership

Specifically, this course will require students to be highly motivated and to dedicate adequate time to the readings and class preparation. Students are expected to conduct themselves with the utmost integrity and to maintain an optimal learning environment for themselves and others.

In this course students are given the opportunity to further develop their abilities to analyze problems logically, carry out mathematical operations, and investigate issues. This is referred to as the Logical-mathematical intelligence in Gardener’s Multiple Intelligences model.

To complete the CPA Professional Education Program (PEP), a candidate must complete six modules: two core modules, two elective modules and two capstone modules. The Capstone modules are culminating courses; in them, a candidate demonstrates what they have learned over the course of the CPA PEP. Both modules are common to all CPA candidates, and are taken after successful completion of the core and elective modules. The MMPA program is unique in that students enrolled in the MMPA program are exempt from the earlier modules and MMPA candidates are allowed to the complete the Capstone Integrative Module as part of their program.

Whether an MMPA student plans to pursue a CPA designation or not, the Capstone Simulations that CPA candidates are required to complete are consistent and aligned with the learning objectives and mission of the MMPA program. Accordingly, all MMPA students will participate in this integrative module and this course is a “Capstone” course of the MMPA program.

In the MMPA program students learn about team management and effective communication in a professional environment. This integrative module is intended to strengthen your team management and communication skills. It will also provide you an opportunity to deepen your strategic leadership competencies by using the knowledge you have acquired throughout the MMPA Program. You along with other students will complete a large business case, Distinct Hotels Corporation. – in which you will play a role primarily as a consultant/advisor. For those students writing the common final examination (CFE), the Distinct Hotels Corporation. Simulation forms the basis of Day 1 of the CFE.

Specifically, this course will require students to be highly motivated and to dedicate adequate time to the readings and class preparation. Students are expected to conduct themselves with the utmost integrity and to maintain an optimal learning environment for themselves and others.

In this course, students are given the opportunity to further develop their abilities to analyze problems logically, carry out mathematical operations, and investigate issues. This is referred to as the Logical-mathematical intelligence in Gardener’s Multiple Intelligences model.

The course is designed to integrate the technical materials learned in performance measurement (financial and management accounting), assurance, tax, finance, information systems and organizational effectiveness with the practical experience obtained by students to date.

The primary objective of the course is to simulate real professional situations, giving students an opportunity to apply technical knowledge and professional judgement to such situations. Application skills will be developed through the use of case materials. An important secondary objective is to develop case writing skills and an approach to writing professional examinations. Given the structure of the MMPA program in response to changes in the CPA program, this course will have a greater emphasis on assurance.

Several of the competencies found in the CPA Competency Map will be covered in this course. From the Assurance perspective, this would include:

- 4.1 Internal Control

- 4.2 Internal and external audit requirements

- 4.3 Internal audit projects and external assurance engagements

By the end of this course, students are expected to be proficient at preparing a solution to an integrated case while drawing heavily upon the enabling competencies of the CPA Competency Map:

- Acting Ethically and Demonstrating Professional Values

- Leading,

- Collaborating.

- Managing Self.

- Adding Value.

- Solving Problems and Making Decisions.

- Communicating

The objective is to expand upon your theoretical background in Finance and to apply these analytical tools to a broad range of investment and financing decisions. Topics to be addressed in this course cover the six competencies in the area of Finance (5.1 to 5.6). The delivery of these topics will be integrated with the knowledge lists in the area of Data Analytics and Information Systems (6.7). Some topics will be integrated with sample cases, models, data, and business intelligence “data analytics” tools (e.g., Excel, Power BI & Python).